Introduction

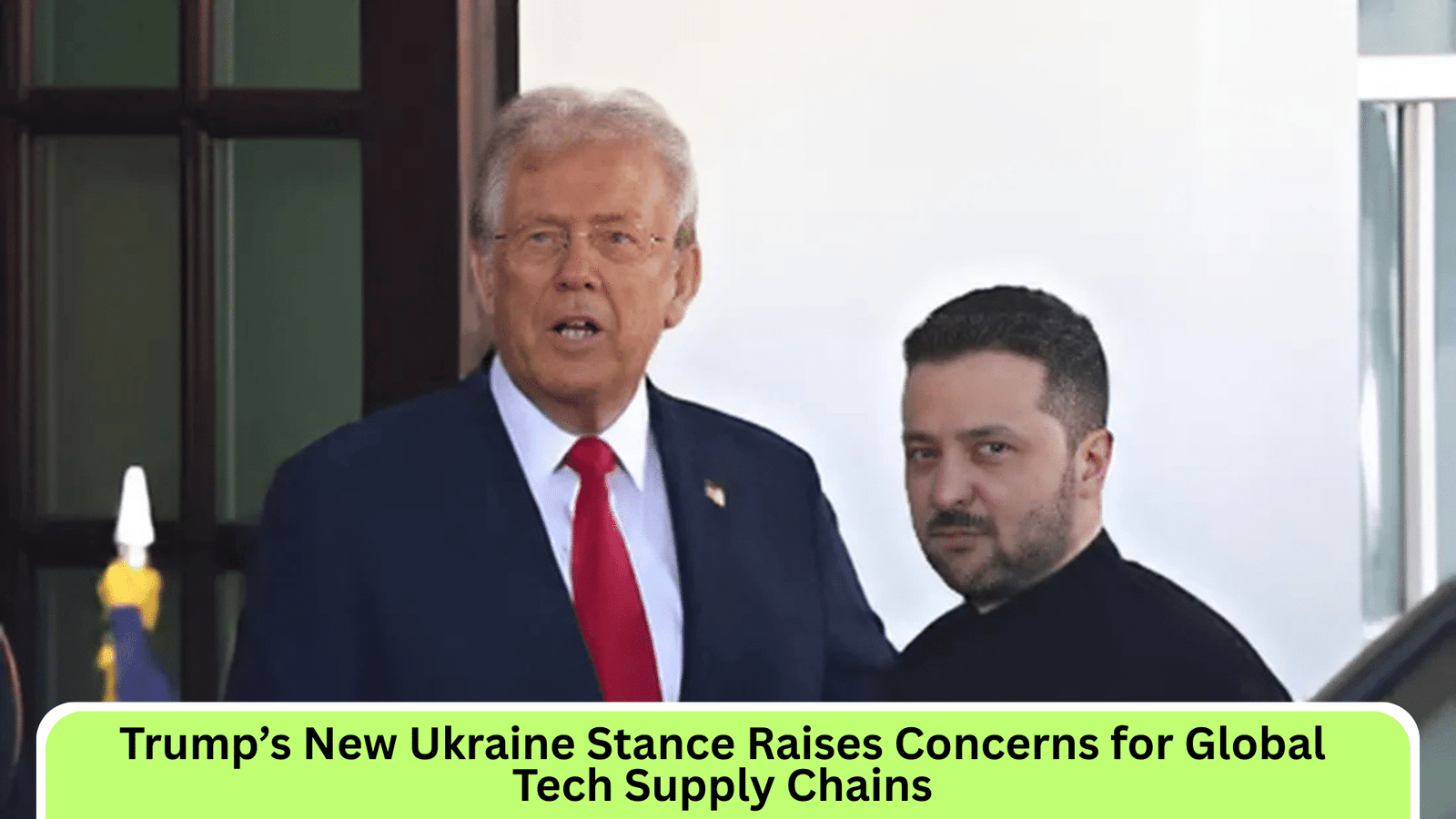

Trump’s New Ukraine Stance Raises Concerns across global markets, particularly in the technology sector. After weeks of suggesting a truce that risked leaving Kyiv exposed, former U.S. President Donald Trump has now urged Ukraine to “fight back.” While ruling out American combat troops, Trump promised techno-military aid including drones, satellite tools, and cyber-defense systems. This pivot, announced on Truth Social, could further disrupt semiconductor and electronics supply chains already strained by the ongoing war in the Eurasian corridor.

Key Points

– Trump’s New Ukraine Stance Raises Concerns over semiconductor supply chains and global chip shortages.

– No U.S. combat troops will be sent; instead, America will provide drones, satellite, and cyber-defense support.

– Ukraine supplies around 12% of global semiconductor raw materials, making disruptions highly impactful.

– International students in STEM fields could face higher lab costs, tighter visas, and reduced internships.

– Experts recommend supplier diversification toward Germany, Taiwan, and Japan to reduce risks.

Table of Contents

Key Developments

– No U.S. troops on the ground: Trump reaffirmed that American soldiers will not be deployed.

– Conditional tech aid: His “Ukraine tech strategy” includes expedited licensing for drones, satellite ranging, and cyber-defense systems.

– Social media pivot: Trump told Truth Social followers that “any war cannot be won without attacking the invader,” indirectly targeting Russia.

– Escalation risks: Experts warn that private arms exports and cyber tools could spark new waves of hacking attacks on global data centers.

How Trump’s New Ukraine Stance Raises Concerns for Tech Supply Chains

• Semiconductor delays: Ukrainian plants facing fire and flooding caused a 22% spike in disruptions in August 2025, according to the Global Semiconductor Database.

• Supply chain volatility: Prolonged instability may raise chip prices and slow deliveries across Asia, Europe, and the U.S.

• Export control tightening: New licensing requirements may affect foreign-owned firms purchasing U.S. software tied to Ukraine’s defense.

Impact on International Students and Research

• STEM students may see costlier lab equipment and limited internship opportunities due to shortages in processors and high-frequency wafers.

• Visa competition is expected to intensify for H-1B and J-1 permits linked to tech internships.

• Cross-border research may face delays, with universities scrambling to source alternatives from Japan, Taiwan, or the U.S.

Expert Insights

Dr. Elena Kovalchuk of the Institute for Eurasian Economic Studies notes that Trump’s New Ukraine Stance Raises Concerns about supplier migration away from Ukraine. She advises:

• Diversify component sourcing from Germany and Taiwan.

• Adopt dual-source strategies to reduce dependency on volatile regions.

• Stay updated on trade alerts from U.S. and EU regulators.

Also Read: Zelenskyy at the White House in Black Jacket

Looking Ahead: What to Expect in the Next 12 Months

1. AI-driven chip manufacturing will grow to offset Ukrainian disruptions.

2. Decoupling of hardware and software supply chains may accelerate.

3. Quantum research hubs in the U.S. and Europe could play a bigger role in reducing semiconductor reliance.

For students, securing visas early and aligning research with non-defense labs may help offset the impact of tighter export controls. Policymakers, meanwhile, must balance U.S. tech sovereignty with European partnerships under the European Chips Act.

FAQs

Q1: What is Trump’s new stance on the Ukraine war?

He now urges Ukraine to “fight back,” promising U.S. technological and intelligence support instead of deploying combat troops.

Q2: How does this affect the global tech supply chain?

Ukraine provides essential materials for semiconductors and 5G. Instability could disrupt chip production and raise global costs.

Q3: Will U.S. troops be sent to Ukraine?

No. Trump reaffirmed no U.S. ground forces will be deployed, only advanced tech aid.

Q4: How are students impacted?

STEM students may face costlier lab tools, tighter visas, and fewer internships tied to European supply chains.

Q5: What can tech firms do?

Experts recommend supplier diversification, sourcing from Germany/Taiwan, and adopting dual-source procurement strategies.