RBI Grade B Recruitment 2025 has officially commenced with the Reserve Bank of India announcing 120 prestigious officer positions across General, DEPR, and DSIM streams. This recruitment represents one of the most sought-after banking opportunities in India, offering exceptional career growth and attractive compensation packages for aspiring banking professionals.

Key Points: RBI Grade B Recruitment 2025

- Total Vacancies: 120 Officers (83 General, 17 DEPR, 20 DSIM)

- Application Period: 10th to 30th September 2025

- Salary: Rs. 1,16,914 per month (including allowances)

- Age Limit: 21-30 years (relaxation for reserved categories)

- Phase 1 Exam: 18th-19th October 2025

- Phase 2 Exam: 6th-7th December 2025

- Official Site: www.rbi.org.in

Table of Contents

RBI Grade B Recruitment 2025: Complete Notification Details

The RBI Grade B application process began on 10th September 2025, following the official notification release on 8th September 2025. This year’s recruitment cycle maintains RBI’s commitment to attracting top talent for India’s central banking operations, with positions available across 30 regional offices nationwide.

The selection process comprises three distinct phases: Phase I preliminary examination, Phase II main examination, and personal interview rounds. Successful candidates will join RBI’s prestigious officer cadre, contributing to monetary policy formulation, banking supervision, and financial system regulation.

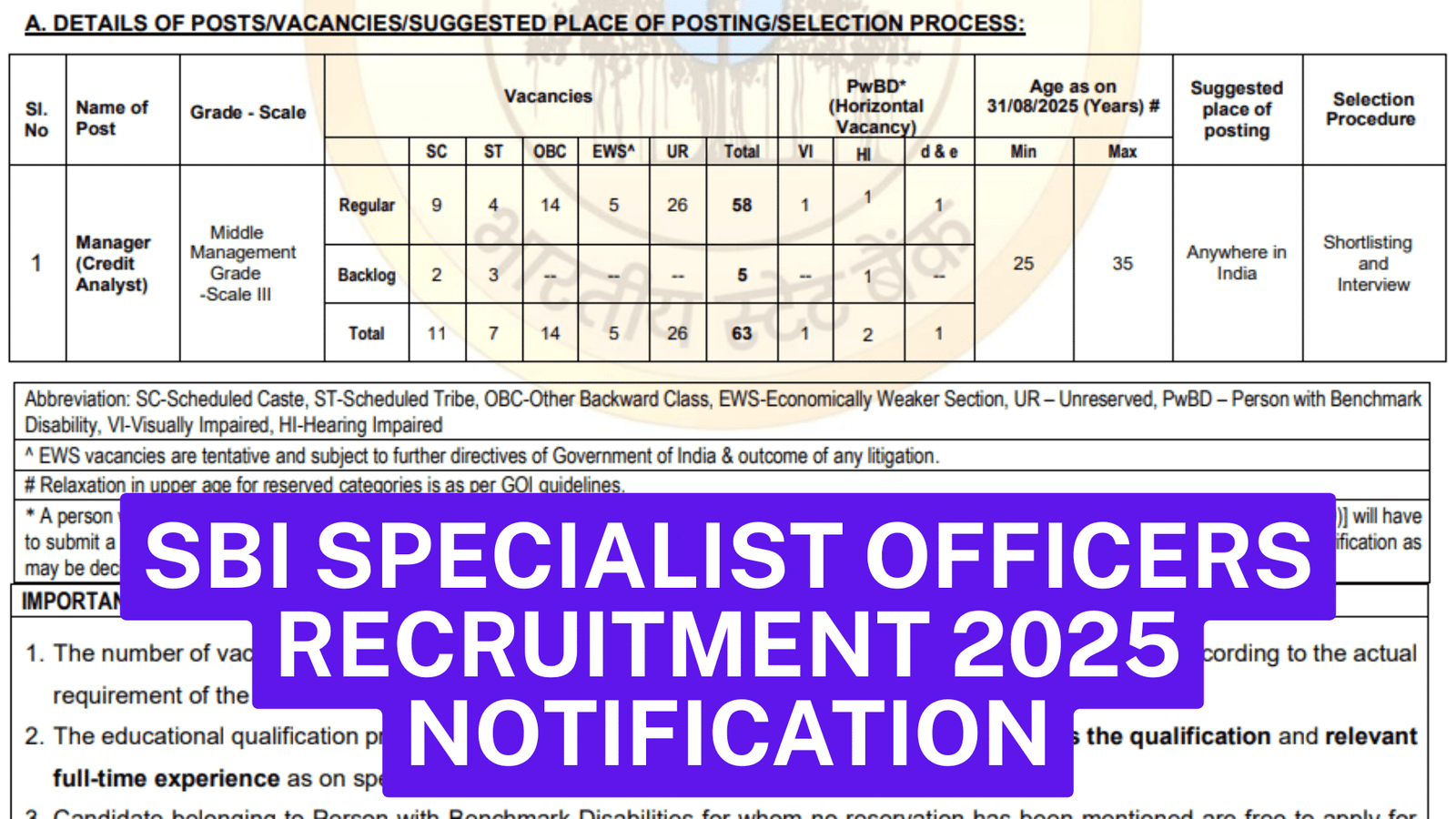

Vacancy Distribution 2025

| Stream | Vacancies | Responsibilities |

|---|---|---|

| Officers Grade B (General) | 83 | General banking operations, policy implementation |

| Officers Grade B (DEPR) | 17 | Economic research, policy analysis |

| Officers Grade B (DSIM) | 20 | Statistical analysis, data management |

| Total | 120 | Multi-stream central banking roles |

RBI Grade B Eligibility Criteria: Who Can Apply

The RBI Grade B eligibility criteria vary significantly across different streams, ensuring specialized talent acquisition for specific departmental requirements. Understanding these requirements is important for a successful submission of application.

Educational Qualifications by Stream

General Stream Requirements:

- Bachelor’s degree with minimum 60% marks (50% for SC/ST/PwBD)

- Post-graduation with 55% marks (pass marks for reserved categories)

- Professional qualifications like CA, ICWA, or CS accepted

DEPR Stream Specifications:

- Master’s degree in Economics, Finance, or Econometrics (55% minimum)

- MBA/PGDM in Finance with 55% marks

- Teaching or research experience provides age relaxation benefits

DSIM Stream Criteria:

- Applicants need a postgraduate degree—specifically in Statistics, Mathematics, or Econometrics—with at least 55 percent aggregate marks.

- M.Stat from Indian Statistical Institute

- PGDBA from ISI Kolkata, IIT Kharagpur, or IIM Calcutta

Age Limit and Relaxations

| Category | Age Range | Upper Age Limit |

|---|---|---|

| General | 21-30 years | 30 years |

| OBC | 21-33 years | 33 years |

| SC/ST | 21-35 years | 35 years |

| M.Phil holders | 21-32 years | 32 years |

| Ph.D holders | 21-34 years | 34 years |

RBI Grade B Exam Dates 2025: Important Timeline

The RBI Grade B exam dates 2025 follow a structured timeline designed to accommodate thorough evaluation processes. Candidates must prepare according to this official schedule to ensure optimal performance across all examination phases.

Complete Examination Schedule

| Event | Date | Details |

|---|---|---|

| Application Opens | 10th September 2025 | Online registration begins |

| Application Deadline | 30th September 2025 (6 PM) | Final submission date |

| Phase I Exam (General) | 18th October 2025 | Preliminary examination |

| Phase I Exam (DEPR/DSIM) | 19th October 2025 | Stream-specific preliminary |

| Phase II Exam (General) | 6th December 2025 | Main examination |

| Phase II Exam (DEPR/DSIM) | 7th December 2025 | Specialized main exam |

| Interview Process | To be announced | Final selection round |

RBI Grade B Salary Structure: Comprehensive Compensation

The RBI Grade B salary structure positions this role among India’s most lucrative banking careers, with a starting gross salary of Rs. 1,16,914 per month. This attractive compensation package includes multiple allowances and benefits that significantly enhance the overall remuneration.

Detailed Salary Breakdown

| Component | Amount (Rs.) | Percentage of Basic |

|---|---|---|

| Basic Pay | 55,200 | Base amount |

| Grade Allowance | 11,500 | 20.8% |

| Dearness Allowance | 23,986 | 43.4% |

| Special Allowances | 9,750 | 17.7% |

| Other Allowances | 16,943 | 30.7% |

| Gross Salary | 1,16,914 | Total monthly |

Career Progression Scale

The pay scale follows a structured 16-year progression: Rs. 55,200-2850(9)-80850-EB-2850(2)-86550-3300(4)-99750. This ensures regular salary increments and career advancement opportunities within RBI’s hierarchical structure.

Banking Job Opportunities: Why Choose RBI Grade B

Banking job opportunities in India’s central bank offer unparalleled professional growth and societal impact. RBI Grade B officers contribute directly to India’s economic stability through monetary policy implementation, financial regulation, and banking supervision activities.

Career Benefits and Growth Prospects

RBI officers enjoy comprehensive benefits including medical coverage, pension schemes, housing assistance, and educational support for children. The organization’s commitment to professional development ensures continuous learning opportunities through specialized training programs and international exposure.

Work Environment and Responsibilities

Grade B officers work in dynamic environments involving economic research, policy formulation, banking supervision, and regulatory compliance. The role demands analytical thinking, decision-making capabilities, and comprehensive understanding of financial markets and economic principles.

Government Job Vacancies: Application Process Guide

Government job vacancies in RBI require meticulous application preparation and timely submission. The online application process demands careful attention to documentation requirements and fee payment procedures.

Step-by-Step Application Process

- Visit Official Portal: Access opportunities.rbi.org.in

- Registration: Create an account with mobile number and valid email address and recheck before proceed

- Fill Application: Complete personal, educational, and professional details

- Upload Documents: Submit photograph, signature, and certificates

- Fee Payment: Pay application fee through online banking/cards

- Confirmation: Download and save application confirmation

Required Documents Checklist

- Recent passport-size photograph (4.5cm x 3.5cm)

- Scanned signature (3cm x 1cm)

- Educational certificates and mark sheets

- Category certificate (if applicable)

- Experience certificates (for DEPR stream)

RBI Exam Preparation Tips: Strategic Approach

RBI exam preparation tips focus on comprehensive study planning and strategic time management. Success in RBI Grade B requires thorough preparation across quantitative aptitude, reasoning, English language, general awareness, and specialized subjects.

Phase-wise Preparation Strategy

Phase I Preparation:

- Focus on speed and accuracy

- Practice quantitative aptitude and reasoning extensively

- Strengthen English language skills

- Stay updated with current affairs

Phase II Preparation:

- Deep dive into economic and social issues

- Study RBI’s functions and monetary policy

- Practice descriptive writing skills

- Develop analytical thinking capabilities

Interview Preparation:

- Study RBI’s recent policies and initiatives

- Understand current economic scenarios

- Practice mock interviews and group discussions

- Develop clear communication skills

RBI Career Opportunities: Long-term Growth Prospects

RBI career opportunities extend beyond initial Grade B positions, offering extensive advancement possibilities within India’s central banking system. The organization’s structured career progression ensures continuous professional development and leadership opportunities.

Promotion Hierarchy and Timeline

Grade B officers can advance through Grade B to Grade A (Assistant General Manager), Grade A to Principal Chief General Manager, and eventually to Executive Director levels. This progression typically spans 15-20 years with consistent performance evaluation and specialized training.

International Exposure and Specialization

RBI officers participate in international banking conferences, central bank meetings, and specialized training programs with institutions like IMF, World Bank, and Bank for International Settlements. These experiences enhance global perspectives and technical expertise.

Conclusion

RBI Grade B Recruitment 2025 presents exceptional opportunities for banking aspirants seeking prestigious careers in India’s central banking sector. With 120 vacancies, attractive salary packages, and comprehensive benefits, this recruitment cycle offers promising prospects for qualified candidates. Interested applicants must complete their applications before the 30th September 2025 deadline to secure their chance at joining India’s premier financial institution.

Frequently Asked Questions (FAQs)

Q1: Is work experience mandatory for RBI Grade B General stream?

No, fresh graduates can apply for RBI Grade B General stream without prior work experience. However, DEPR stream candidates with teaching or research experience receive age relaxation benefits.

Q2: Can I apply for multiple streams simultaneously?

No, candidates must choose one specific stream (General, DEPR, or DSIM) during application. Multiple applications for different streams are not permitted.

Q3: What is the validity of RBI Grade B selection?

The selection list remains valid for one year from the date of result declaration. Selected candidates may be offered positions based on vacancy availability during this period.

Q4: Are there any sectional cut-offs in RBI Grade B exams?

Yes, both Phase I and Phase II examinations have sectional and overall cut-off requirements. Candidates must qualify in each section individually and achieve minimum total scores.

Q5: What happens if someone miss the application deadline?

RBI strictly adheres to application deadlines. Late applications are not accepted under any circumstances, so candidates must submit applications before 30th September 2025, 6 PM.