Table of Contents

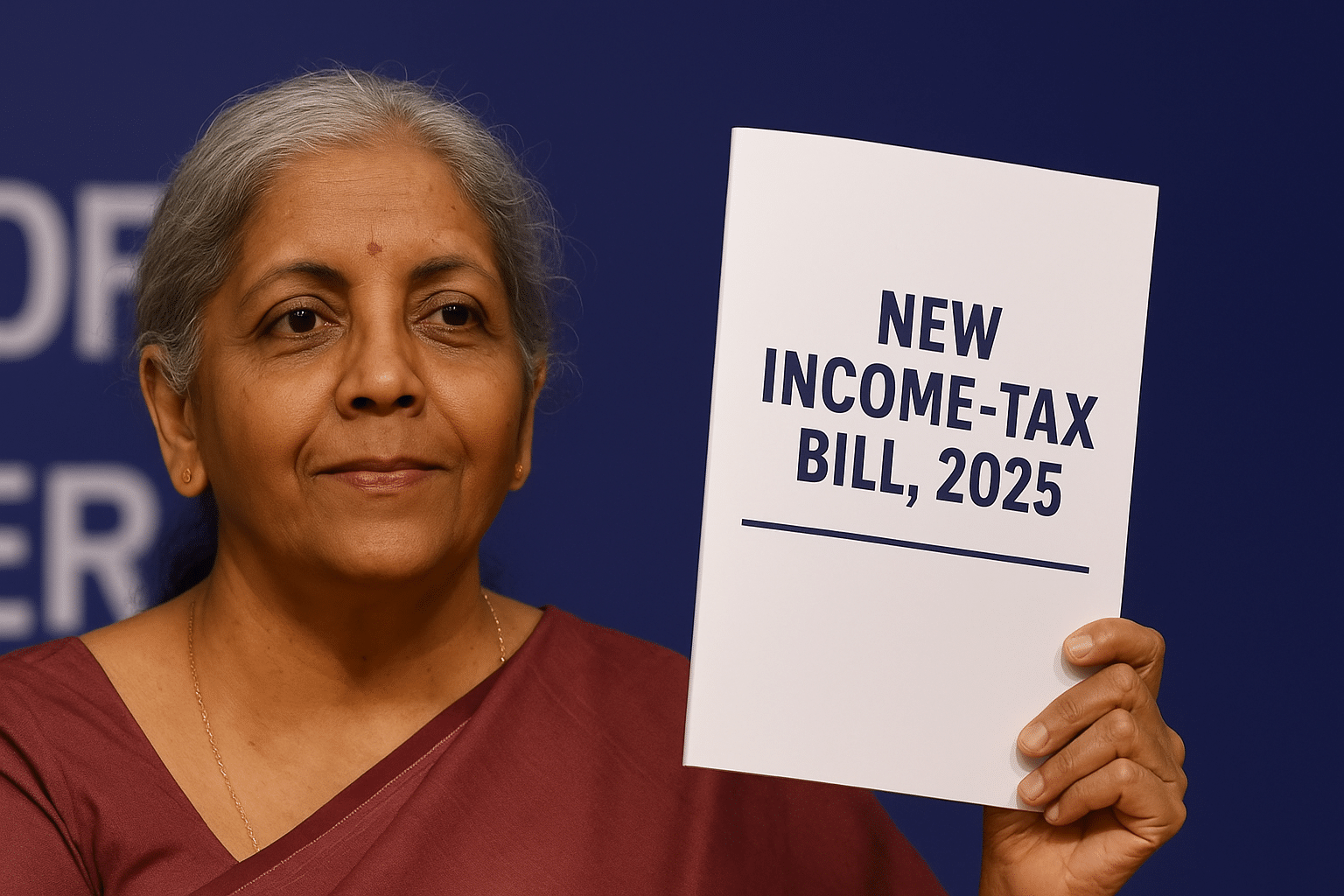

Nirmala Sitharaman Tables Revised New Income-Tax Bill 2025

Finance Minister Nirmala Sitharaman has tabled the New Income-Tax Bill, 2025 in Parliament, introducing a modernised and simplified framework to replace the Income-Tax Act of 1961. The move follows the withdrawal of an earlier draft and is intended to make tax law easier to understand, less litigation-prone, and more transparent.

Key Highlights of the New Bill

Structural Overhaul

The bill reduces the number of sections from 819 to about 536 and trims chapters from 47 to 23, aiming to make the law more concise and user-friendly. This structural clean-up also eliminates redundant provisions and complex cross-references that often led to confusion.

₹12 Lakh Zero-Tax Threshold Maintained

The revised bill keeps the earlier announcement that no income tax will be levied on annual income up to ₹12 lakh under the new regime. This move is designed to provide relief to a broad section of middle-income earners.

Digital-First, Faceless Assessments

A major reform is the strengthening of faceless assessment procedures, enabling digital interaction between taxpayers and the department. This is expected to reduce discretion, speed up processes, and enhance transparency.

Procedural Improvements

The bill introduces clear notice requirements before adverse action, streamlined refund processes, and refinements to TDS and TCS compliance. These changes aim to reduce disputes and make compliance smoother for individuals and businesses.

Sector-Specific Adjustments

- Retirement and Pension Rules: Aligns the taxation of withdrawals under the Unified Pension Scheme with the National Pension System for greater parity.

- Charitable Entities: Clarifies the treatment of anonymous donations and certain trusts to ensure consistent tax application.

Timeline of Changes

- August 8, 2025: Government withdraws the earlier draft after receiving the Select Committee’s recommendations.

- August 11, 2025: Revised bill introduced in the Lok Sabha for debate.

- April 1, 2026 (proposed): Expected date for the new law to take effect, subject to parliamentary approval.

Why the Select Committee’s Role Was Key

The Select Committee reviewed the original bill in detail and proposed several hundred drafting and procedural improvements. Incorporating these changes into a single, consolidated bill is intended to ensure clarity and avoid conflicting interpretations.

Impact on Stakeholders

For Taxpayers:

Middle-income earners benefit from the unchanged ₹12 lakh exemption, while the simplified law should make compliance less burdensome.

For Businesses:

Clearer definitions and a reduced section count can ease compliance, though companies will need to adapt to new formats and rules.

For Advisors:

Accountants and tax consultants will have a period of adjustment as they interpret and implement the updated provisions.

What to Expect Next

- Parliamentary scrutiny to identify any ambiguities.

- Implementation rules from the Central Board of Direct Taxes after passage.

- Judicial interpretations over the coming years as new provisions are tested in real-world disputes.

Bottom line:

The Nirmala Sitharaman new income tax bill represents a major overhaul of India’s tax framework, focusing on simplification, digital transformation, and procedural fairness, without altering the core relief announced earlier. Its true impact will depend on how Parliament, the tax administration, and the courts shape its implementation.

FAQs:

Q1 What is the New Income-Tax Bill 2025 introduced by Finance Minister Nirmala Sitharaman?

The New Income-Tax Bill 2025 is a comprehensive overhaul of India’s existing Income-Tax Act of 1961. It aims to simplify the tax law by reducing the number of sections and chapters, enhancing digital processes, and making compliance easier for taxpayers and businesses.

Q2: When will the new income tax law come into effect?

The new law is proposed to come into effect from April 1, 2026, subject to parliamentary approval and completion of all formalities.

Q3: Has the income tax exemption limit changed in the new bill?

No, the bill maintains the ₹12 lakh annual income exemption threshold under the new tax regime, providing relief to middle-income earners.

Q4: How does the new bill improve the tax assessment process?

The bill strengthens faceless assessment procedures, enabling digital interaction between taxpayers and tax authorities, which is expected to increase transparency, reduce discretion, and expedite processes.